“Be Fearful When Others Are Greedy” - How The Recession Will Surprise Everyone - A Prediction (2024-2039)

Things are looking tippy tippy… might be time to be fearful

A Note One Predictions:

Economist have predicted 22 of the last 2 recessions. It is impossibly hard to make predictions because so much information is unknowable to us. We often look at events in hindsight and think to ourselves “Of course that’s what happened, it’s so obvious”.

This is called hindsight bias and it’s very dangerous because it gives us a false sense of understanding of the world and how predictable future events will be.

Humans in general are laughably bad at predicting the future. that’s why most investors buy high and sell low, and economist who are allegedly the brightest market predictors (Their job) are consistently wrong. .

I’m going to put myself out there and make some bold market predictions. Spanning the next 15 years. An absurdly long time frame as most economist can’t even predict what will happen this year. We don’t even know who the president in 2025 will be.

The purpose of this exercise is as follows:

To demonstrate how poorly I am at fortune telling

Offer one possibility or a recession and what may happen. even if this doesn’t transpire it’s still useful to think thru what you might do in a future recession.

For fun, because it’s intersting to look at he past and try to apply it to the future

As we head into 2024 the FED will be cutting rates while stock markets are at all time highs. We’ve seen this before & I’m becoming fearful while others are greedy. Here’s my breakdown.

2024 April Fed starts rate cuts

Seems like the FED has done enough, I’m predicting that as Q4-2023 earnings come in we will see strong revenues, but margins will be down More lay offs, and cooling inflation (real or not)

Cuts will be in April-June time frame If they cut too soon it signals to the market there is a problem. if they wait too long they could make the coming recession worse than it needs to be, and the FED knows this.

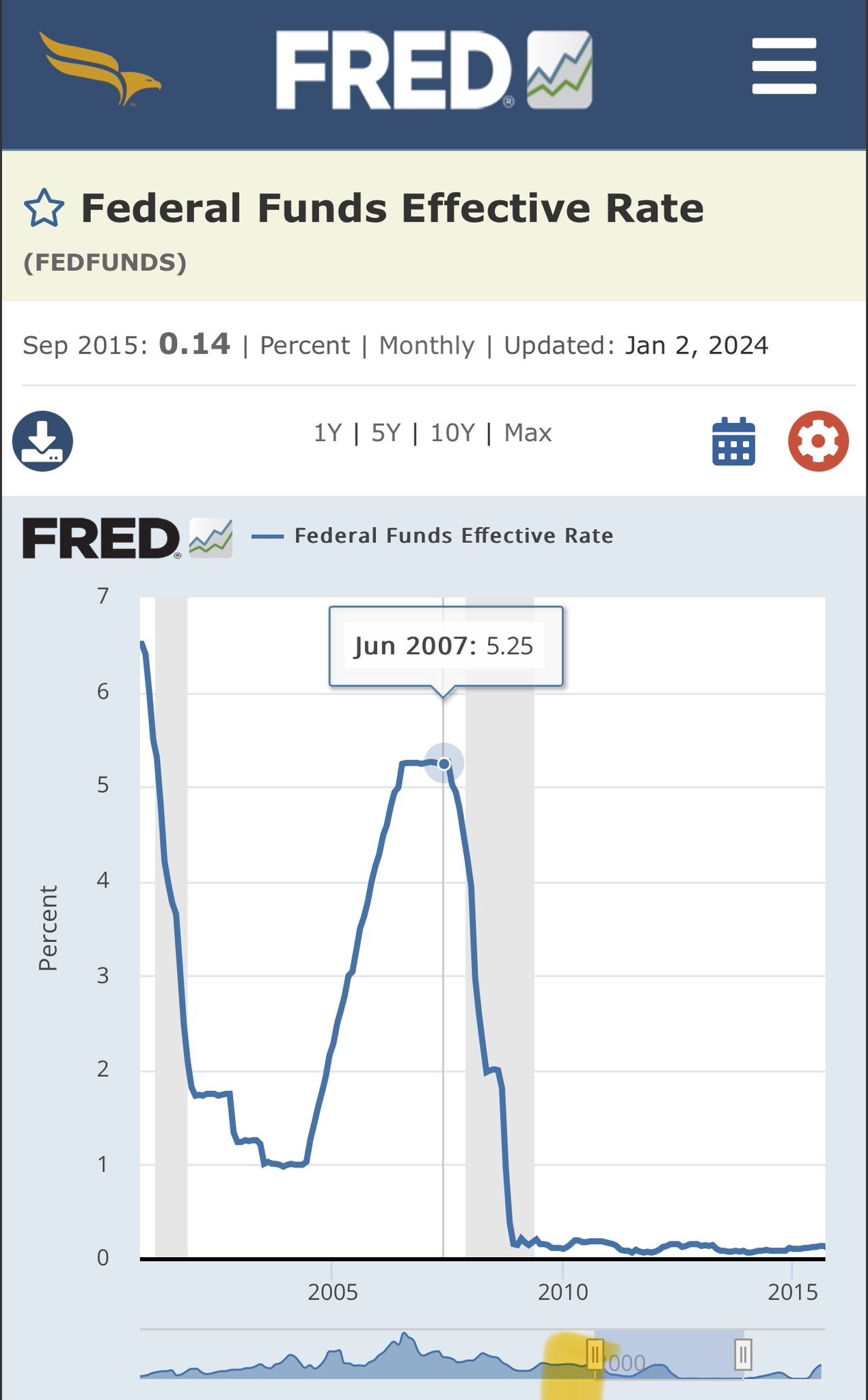

Notice in the chart below the FED started cutting rates in June of 2007 which preceded the GFC 2008 recession. This is a typical pattern for most recessions.

Chart showing FED rate cut in June 2007

2024 June Stock Markets Top

In both 2007 & 2000 the stock market topped about 2 months after the first FED rate cut

People get excited about a “Soft Landing” & think cheaper money will lead to a rally in assets It’s not a perfect indicator but it’s pretty good.

Check out the date on this headline, sound familiar?

2025 July Major Market Crash

Notice, I said the market topped in 2007 in the GFC?

But we remember it as the 2008 crash…

That’s because there is about a 1 year lag between the stock market top and when the real pain starts. This period is when you probably want to be in cash.

Several reasons for this including job losses piling up and traders being forced to close losing positions.

Below is a chart showing the August 2007 top in the S&P500

Chart Showing the S&P500 top in August 2007

2025 November-Janduary Stock Markets Bottom

This is where things get interesting. These crashes are typically fast & recovery normally starts immediately.

People will panic sell at the bottom

People will be losing jobs

Money will be tight

Classic buyers market paradox, this is when you should be all in, but nobody will have cash This crash will be painful but quick (2-3 months). We saw this in 2020, & 2008. Most people will completely miss the bottom

The last exception to this was the dot com bubble which had a longer slump of 12 months in the NASDAQ 2000-2001

2026 July Unemployment Peaks (7.5%}

You thought all that was bad? The public is just starting to feel the real pain!!

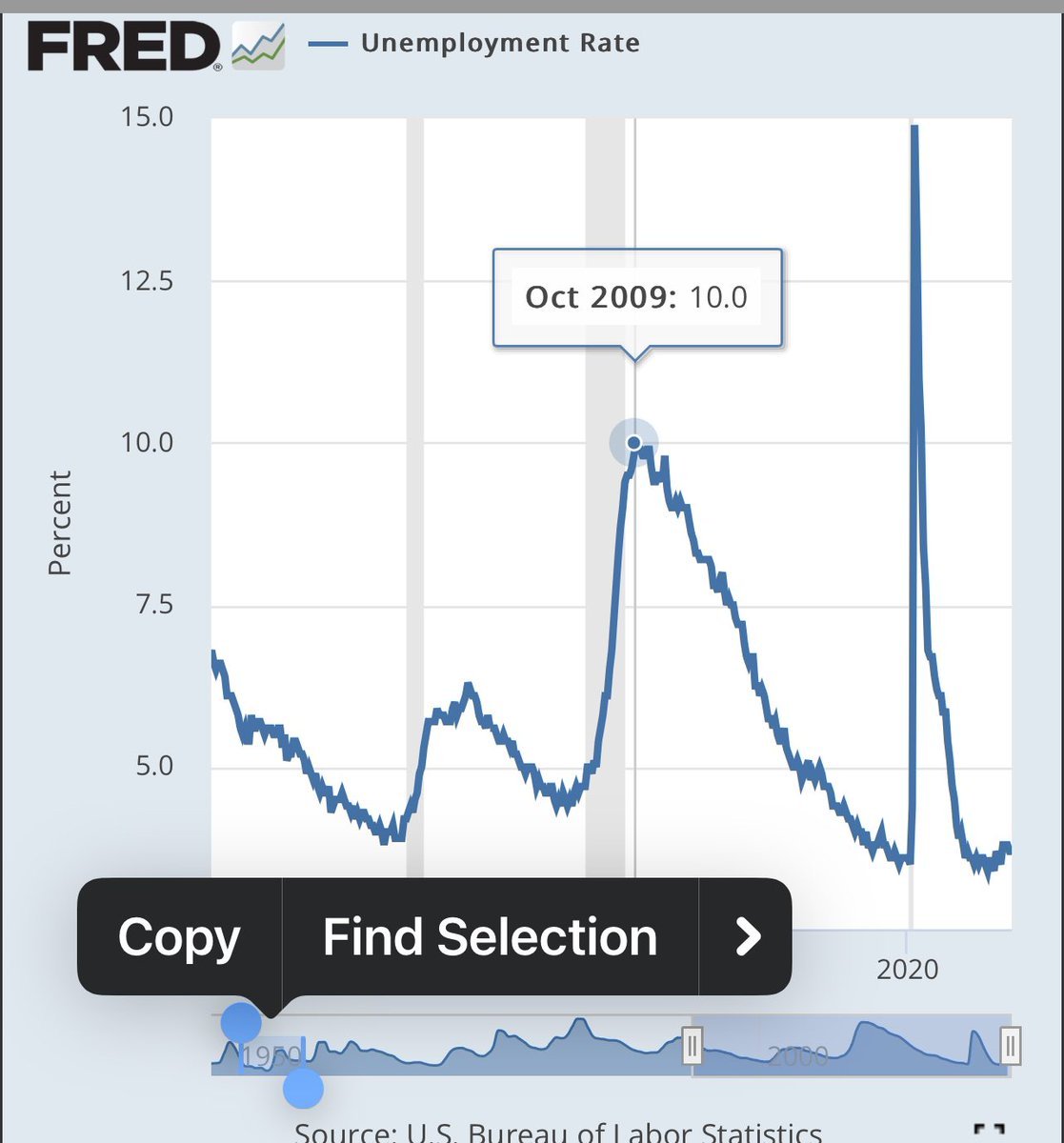

About a year after the market crashes hard we’ll see unemployment peak. In 2009 this was around 10% In 2020 this was closer to 15%

I hope we’ve learned from our mistakes in 2008 and I suspect QE will be in full swing by now moderating the severity of the unemployment rate.

That’s why I’m calling it 7.5%. It may also top up to 6 months earlier than this due to policy maker intervention

CharChart showing the October 2009 peak in unemployment (10%)

2028 November Housing Market Bottoms

Now I’m really sticking my neck out trying to call things 4+ years in the future but here we go!

Housing always lags because it’s largely dependent on the job market. People won’t be forced to sell homes at a lower price without job losses & unemployment there will be some forced selling.

Again I don’t think it’ll be as bad as the GFC which saw a surge in foreclosures. But building will largely stop, and there will be a 2-3 year lull in the housing market.

I’m forecasting it will pivot in November 2027 or 2028. Unemployment/ jobsalways drives the housing market and it moves slow. Another fact doom posters here on X don’t understand

2029-2039 Raging Bull Market

2029-2039 Raging Bull Market

Now I know this post has been doom & gloom.

But this is just the normal economic cycle in a country with global reach & heavy handed policy makers. This is actually healthy!

Zombie companies who are largely unprofitable will be forced out of business & talented people will lose jobs This frees space in the market place for stronger companies and allocates talent where it is needed most.

This will set up a MASSIVE bull market one that will likely put the 2012-2022 market rally to shame.

No Pain No Gain!!

I want to finish with the 2nd half of the quote I started this power with.

“Be greedy when others are fearful”

Doomers have predicted 22 of the last 2 recessions. When this correction happens it will be very hard & fast. You will be scared shitless, possibly even unemployed. There will be no “buy the dip” or “stocks on sale” In the news or on social media.

Everyone will be saying “This is the next Lost Decade” That’s exactly when you should be going all in!

Hope you enjoyed this read, remember predicting the future is impossibly hard, what I’ve outlined above is just one possibility based on how the past few recessions have played out. Events that we have no way of knowing about can quickly unfold to put us on an entirely different path at any time!